Exness Scalping Strategy: A Comprehensive Guide for Traders

In the fast-paced world of forex trading, scalping has emerged as a popular strategy for those looking to capitalize on short-term price movements. With a platform like Exness, traders can leverage various tools and features that enhance their scalping experience. In this article, we delve into the intricacies of the Exness Scalping Strategy, incorporating key techniques, best practices, and real-world examples. For additional insights, check out this resource: Exness Scalping Strategy http://shop.coralite.co.za/?p=235099.

What is Scalping?

Scalping is a trading strategy that focuses on making numerous small profits from minor price changes throughout the day. Traders utilizing this strategy, known as scalpers, typically hold positions for a very short duration, often just a few seconds to several minutes. The aim is to accumulate small profits that, when scaled up, can lead to significant gains over time.

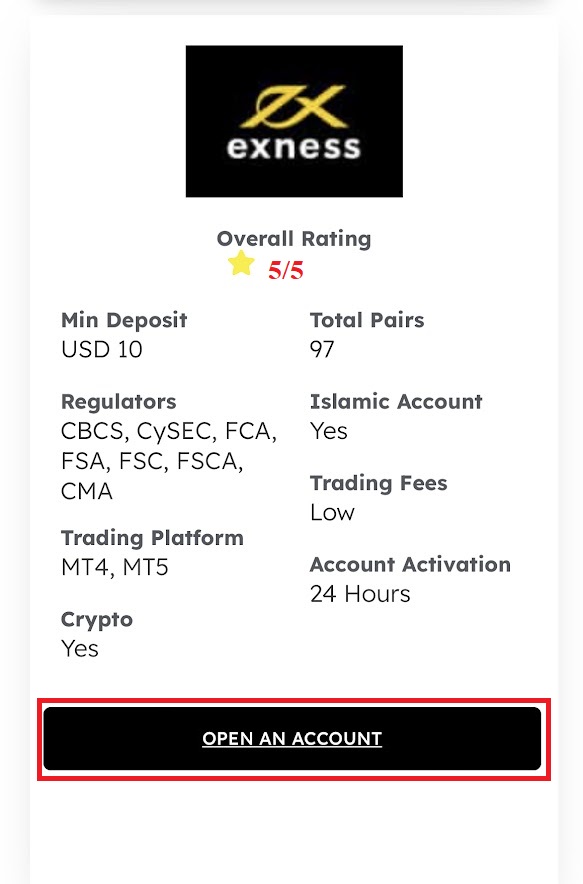

Why Choose Exness for Scalping?

Exness stands out as a broker of choice for scalpers for several reasons:

- Low Spreads: Exness offers competitive spreads, which is crucial for scalpers who rely on minimal price fluctuations to make profits.

- Quick Execution: Fast order execution times ensure that traders can enter and exit positions promptly, which is essential in scalping.

- Variety of Instruments: Exness provides access to a diverse range of trading instruments, including currency pairs, commodities, and cryptocurrencies.

- Leverage Options: Scalpers can benefit from high leverage offered by Exness, increasing their potential returns while carefully managing risk.

Developing a Winning Exness Scalping Strategy

To create a successful scalping strategy on the Exness platform, consider the following components:

1. Technical Analysis

In scalping, technical analysis plays a pivotal role. Scalpers often rely on indicators to identify potential entry and exit points. Key indicators include:

- Moving Averages: Use short-term moving averages to spot trends and reversals.

- Bollinger Bands: These can help identify volatility and potential overbought or oversold conditions.

- Relative Strength Index (RSI): This momentum indicator can indicate potential reversals by showing when the asset is overbought or oversold.

2. Timeframes

Most scalpers operate on lower timeframes, such as 1-minute to 5-minute charts. These charts provide the granularity needed to spot price movements effectively. It is essential to stay focused and disciplined while trading on these short timeframes.

3. Risk Management

Effective risk management is the cornerstone of a successful scalping strategy. Here are some tips to manage risk effectively:

- Set Stop Losses: Protect your capital by setting stop losses for each trade, particularly in volatile markets.

- Position Sizing: Determine your position size based on your overall capital and risk tolerance. Aim to risk only a small percentage of your account on each trade.

- Avoid Overtrading: Ensure you’re selective with trades to avoid unnecessary losses. Quality over quantity is vital in scalping.

Executing Trades on Exness

Once you have developed your strategy, it’s time to implement it on the Exness platform. Here are some steps to follow:

- Choose Your Market: Select liquid markets that offer enough volatility for scalping.

- Make Use of Limit Orders: In scalping, using limit orders can help you enter trades at desired price levels.

- Monitor Economic News: Be aware of scheduled news releases that could create volatility in the market.

Practicing Your Scalping Skills

Before diving into real trading, it’s crucial to practice your scalping strategy. Exness offers demo accounts that simulate real trading conditions without risking real money. Use this opportunity to refine your skills and tweak your strategies based on trials.

Conclusion

The Exness Scalping Strategy can be a highly rewarding trading approach when implemented correctly. By focusing on technical analysis, managing risks effectively, and utilizing Exness’s favorable trading conditions, you can enhance your scalping endeavors. As with any trading strategy, continuous learning and adaptation to market conditions are essential for long-term success.

In summary, if you’re considering entering the world of scalping, take the time to craft a solid strategy and ensure you’re comfortable with your trading plan. Start with a demo account to build confidence and experience, then transition to live trading as you gain expertise.